Alibaba is a Top AI Stock at a Deep Value Price

Alibaba leads China's booming AI and LLM cloud markets

China’s tech sector has been devastated over the past few years. The Invesco China Technology ETF (CQQQ) is down about 68% from its February 2021 high. The country’s housing bubble has popped (or is popping), and the entire market got smashed as a result.

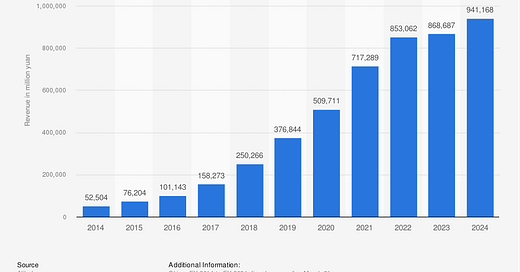

Alibaba (BABA), once the darling of Chinese tech stocks, is down about 71% from its October 2020 all-time high of $306. At $75.80 as of writing, shares are trading not far above the company’s 2014 IPO price of $68. Here’s how revenue has grown since then.

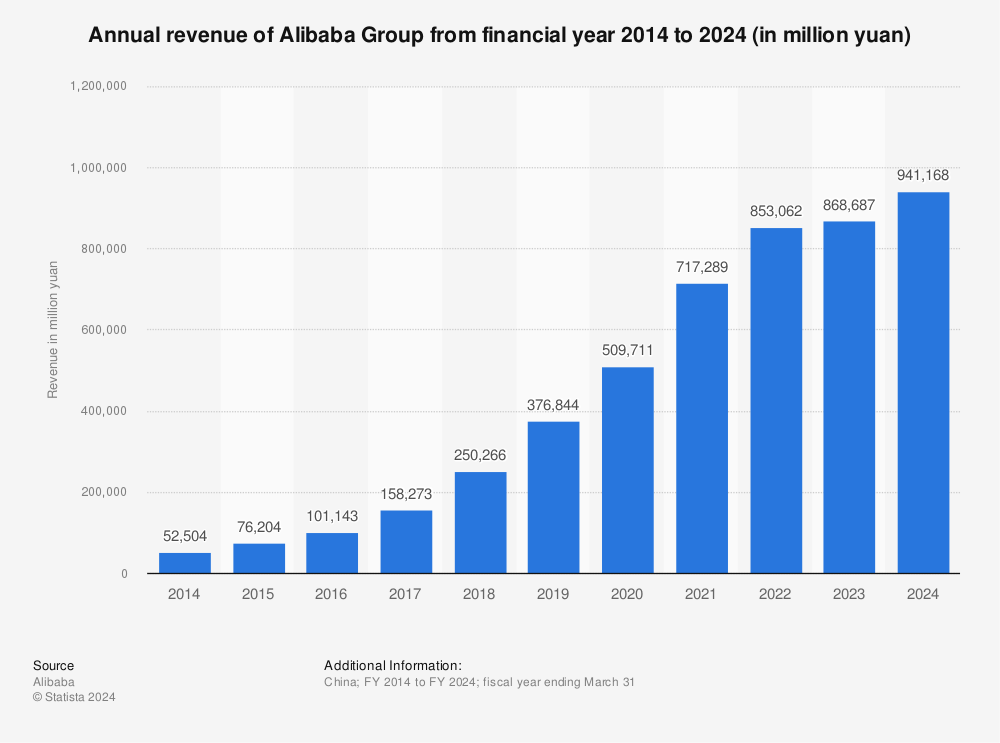

It is remarkable that BABA 0.00%↑ is trading near its IPO price after an 18x increase in revenue over the last decade. Shares currently trade at a near-record low price/sales ratio of just 1.54. Here’s a historical chart:

Currently BABA 0.00%↑ trades at a trailing P/E ratio of 18x and a forward estimate of 9x. It’s important to note that trailing earnings were impacted by mark-to-market losses due to plunging Chinese equity prices over the past year (Alibaba owns equity in a many public and private companies, and when those values fall, it is reflected in the company’s earnings).

Alibaba currently has about $50 billion of net cash (at a market cap of ~$179B). Sporting a free cash flow yield of ~11%, Alibaba is cheap. Especially compared with richly-valued AI stocks like NVIDIA (NVDA) at 36x price/sales, and Microsoft (MSFT) at 13x price/sales.

Alibaba Leads China’s AI Market

Most investors I talk with are not aware that Alibaba Cloud has developed AI models which are competitive with GPT-4o and Claude 3.5. Interestingly, one of Alibaba’s best models, Qwen2 (try it here), is open-source, meaning anyone can freely use it, even for commercial purposes.

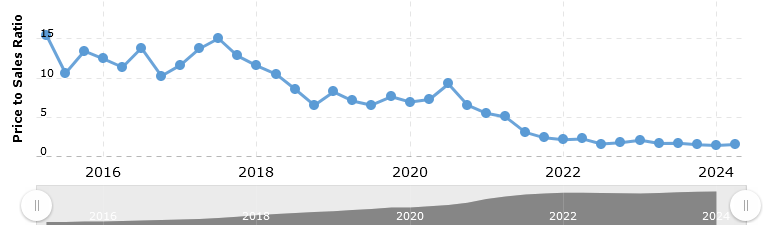

According to Hugging Face’s Open LLM Leaderboard, Alibaba’s Qwen2 is the best open source large language model (LLM) in the world, by a good margin.

As background, Hugging Face is the “Github of AI” and was valued at $4.5 billion in its latest funding round. Their open source leaderboard is widely followed in the industry. It’s worth noting that Alibaba owns the Chinese version of Hugging Face, Modelscope.

In the HF ranking, Qwen2 handily beats open-weight models from heavyweights including Meta, Mistral, and Microsoft. This is based on an average of 6 benchmarking scores covering key LLM capabilities.

Qwen models also do well when stacked against the world’s best “closed source” LLMs. To get a read on this, let’s take a look at another widely followed LLM leaderboard, the LMSYS Chatbot Arena Leaderboard. This leaderboard is based on a blind comparison between 2 models voted on by users.

For Chinese queries, Alibaba’s Qwen-Max model is only about 3% behind OpenAI’s GPT-4o. This means in a blind head-to-head matchup, Qwen wins about 47% of the time against the top-ranked models in the world. That is hugely substantial. Alibaba’s models are already competitive with the cutting-edge.

Wide-Open AI Opportunity in China

Importantly, Alibaba is not competing against GPT-4 and Claude 3.5 in China. On July 9 2024, access to OpenAI’s APIs in China was turned off by the company. According to a friend in Beijing, even VPN access is sometimes blocked by OpenAI. Anthropic’s impressive Claude models are also blocked at the country IP level, but apparently can be accessed via VPN, for now.

Since OpenAI cut off developer access to Chinese developers, business is booming for Alibaba Cloud according to Qwen program manager Wang Xiaoming.

"We observed a significant number of developers and users turning to Tongyi Qianwen [Qwen] large model and API. In terms of technology, we are catching up with and have even surpassed ChatGPT-4 in some capabilities, particularly in the processing of long documents, images, audio, and video," Wang said.

In the world of LLM development, access to proprietary data sources is a key advantage. And Alibaba has a trove of unique ecommerce and business data, rivaled only by giants like Amazon.

Another opportunity worth noting is that Apple is currently in the market for an AI partner in China. Since OpenAI and Anthropic are not operating in China, Apple needs a local partner to integrate with the iPhone. According to the WSJ, Apple is considering a partnership with Alibaba, Baidu, and Baichuan among others. If Alibaba manages to win Apple’s China AI business, that would be a significant vote of confidence.

As a bonus, BABA 0.00%↑ owns large stakes in some of China’s fastest-growing AI unicorns, including 01.AI (estimated 10-20% equity ownership) and Moonshot AI (36% stake, purchased with cloud credits). The company also has developed its own proprietary AI accelerator chips (similar to GPUs, but specialized for AI tasks).

Monetizing Large Language Models (LLMs)

Alibaba is monetizing its leading AI expertise in two ways.

Selling LLM (AI) access via Alibaba Cloud directly and through API

Offering AI tools to merchants on its ecommerce platforms

Alibaba Cloud is a fully-owned subsidiary of BABA and is the leading cloud provider in China with approximately 39% of the market. According to a May 2024 China Daily article, Alibaba Cloud’s enterprise AI offerings had already attracted more than 90,000 corporate clients.

Alibaba said earlier this month that its LLMs have been adopted by more than 90,000 corporate clients in a wide range of industries, one month after Baidu said its enterprise-level LLM platform Qianfan had been used by 85,000 business users.

Alibaba appears to be in the lead in the Chinese enterprise LLM market. With that said, competition in China is absolutely brutal, so meaningful revenue from this business may be a year or more out. But the fact that they’re already in a leadership position is promising.

In terms of using AI to help its merchants sell more, I found some details in the WSJ’s recent article “Alibaba Leans Into AI to Draw Shoppers Beyond China”:

Alibaba’s family of generative AI models and new teams focused on AI applications are beginning to support the company’s drive to expand well beyond China, including by helping small sellers overcome language barriers and take on more complex tasks like negotiating refunds, said Zhang Kaifu, head of AI development at Alibaba’s international e-commerce unit.

The WSJ piece quotes an Alibaba representative as saying the company has more than 500,000 merchants currently using its new AI tools. According to the article, some merchants are seeing a 30% bump in sales. As these tools are refined, they should become extremely useful to both merchants and Alibaba itself.

Alibaba is not going to be left behind as AI transforms the business world. Importantly, the company should continue to attract top AI and deep learning talent, especially considering their impressive open source efforts, which are known to attract highly-coveted AI researchers.

Alibaba is currently my favorite “AI stock”, and it’s not even close. The stock is cheap and the business is still growing, with revenue up 7% YoY in the most recent quarter. Buybacks are flowing, the company is cash-rich and recently instituted a $1 per share annual dividend. Now the company has a real chance to reinvigorate growth by tapping into its leading AI expertise. Once the market realizes this, I believe we will see a positive re-rating of Alibaba’s valuation.

Risks

Fundamentally, I believe downside in Alibaba is limited by its strong net cash position, new $25 billion buyback program, and continued growth in its Cloud and international businesses.

One significant concern is rising tension between the U.S. and China. It is possible that if the relationship continues to sour, Chinese equities could potentially be de-listed from the U.S. (like Russian stocks and ETFs were after the country invaded Ukraine). However, this would be a dramatic step, and I don’t see it happening. Both sides have too much invested to make this anything but a desperation option.

The last risk worth mentioning is that as a Chinese company, Alibaba is limited in the GPUs it can purchase from US vendors such as NVIDIA. The entirety of China is essentially banned from buying top-tier GPUs like the NVIDIA H100. As a result, Alibaba’s fleet of GPUs is subpar compared to competitors like Microsoft, Amazon, and Meta. However, they do operate a large fleet of lesser NVIDIA GPUs and domestic competitors, and appear to be able to rent the most capable GPUs, at reasonable prices, for model training purposes.

Look for part 2 of this series soon on BasedAI.com, where we’ll cover Alibaba’s leading position in electronic payments via its 33% stake in Ant Group (Alipay), its booming international business (Aliexpress in the US), buybacks, rising Chinese ecommerce competition, and more.

Disclosure: I own Alibaba (BABA) and Microsoft (MSFT) shares in personal accounts. I have no position in any other company mentioned in this article. I have no business relationship with Alibaba or any other company mentioned in this article.

As a previous AI product manager working in Alibaba Cloud, I would say Alibaba Cloud has the best AI releated resources.

Great article, Adam. I look forward to future ones as well.